€00.00

€00.00

€00.00

Free Malta VAT Calculator: Get 100% Accurate & Instant Results

Welcome to the Malta VAT Calculator, a powerful tool for swift VAT calculations. Designed with simplicity and efficiency, this tool empowers you to add or remove VAT with just a few clicks swiftly.

Our calculator guarantees accuracy and convenience. It can handle complex VAT calculations in a fraction of a second, making it suitable for business and personal use. Vat calculator Malta saves you time and lets you do complex VAT calculations in less than a second. You can trust this calculator if you want accuracy and efficiency.

Malta VAT Rate

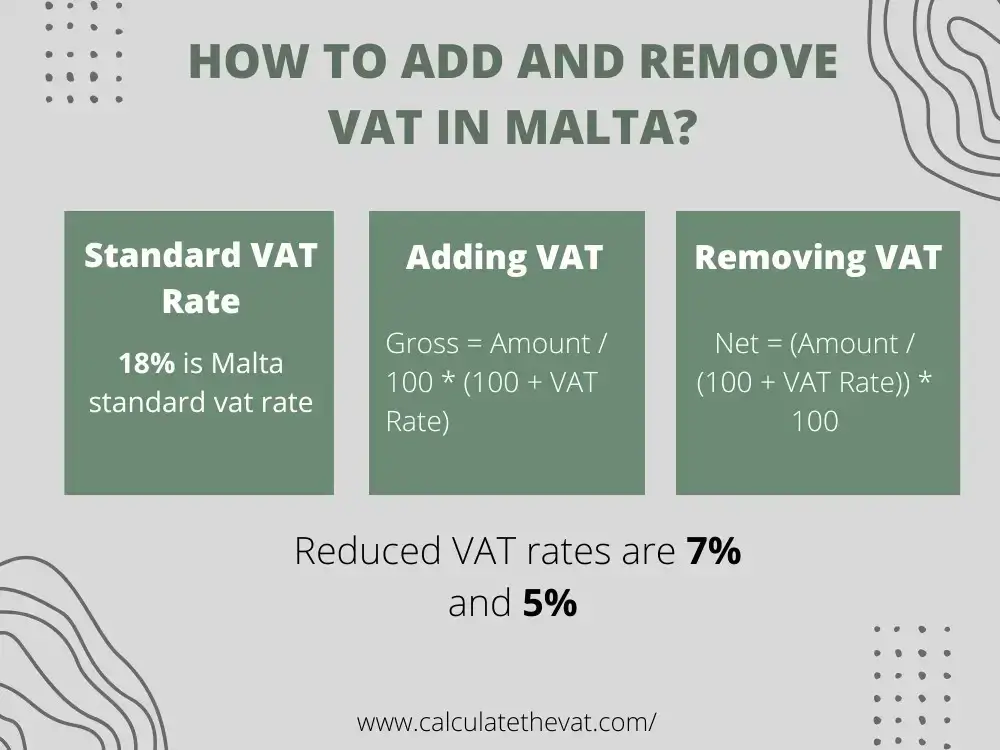

The current VAT rate in Malta is 18% for most products and services. There are also reduced VAT rates of 7% and 5%. The 7% rate applies to specific goods and services like tourist accommodation and sporting facilities.

In comparison, the 5% rate applies to a broader range, including electricity, specific medical supplies, and some imported goods.

Overview of Malta VAT Rates

| Rate | Description | Examples |

|---|---|---|

| 18% | Standard VAT Rate | Most goods and services not listed below |

| 7% | First Reduced VAT Rate | Tourist accommodation, sporting facilities |

| 5% | Second Reduced VAT Rate |

|

| 0% | VAT Exempt Malta |

|

Also visit; Ireland VAT Calculator

How to Add and Remove VAT in Malta?

Adding VAT in Malta

Use the following formula to find out the amount of VAT

Gross = Amount / 100 * (100 + VAT Rate)

Step 1:

Select the standard rate, The standard vat rate in malta is 18%.

Step 2:

Divide the Amount by 100 and then multiply by the (100 + VAT rate); the result will be the gross amount, including the Malta VAT.

Step 3:

Now, calculate VAT amount from gross amount as is follow:

Total VAT = Gross - Price

Example of Adding VAT

Let suppose you buy a Laptop on €29 and malta standard vat rate is 18%, then the total cost including the vat would be:

Amount = €29

VAT Rate = 18%

Gross Amount = Amount / 100 * (100 + VAT rate)

Gross Amount = 29/100*(100 + 18)

Gross Amount = €34.22

Now,

Total VAT = Gross Amount - Amount

Total VAT = €34.22 - €29

Total VAT = €5.22

Therefore, the total price, including VAT (gross price) for the laptop is €34.22.

Removing VAT in Malta

Use the following formula to find out the price without VAT

Net = (Amount / (100 + VAT Rate)) * 100

Step 1:

The standard maltese vat rate is 18%

Step 2:

Divide the Amount by the (100 + VAT rate) and then multiply by 100; the result will give you a net amount that doesn’t include any VAT.

Step 3:

You can get the total vat as is follow:

Total VAT = Amount - Net

Example of Removing VAT in Malta

Let's consider you sell a laptop for €25 and need to remove VAT from the selling price. With VAT at a rate of 18%, the selling price excluding VAT would be:

Amount = €25

VAT Rate = 18%

Net Amount = Amount/(100 + VAT Rate)* 100

Net Amount = 25/(100 + 18)* 100

Net Amount = €21.19

Now,

Total VAT = Amount- Net Amount

Total VAT = €25 - €21.19

Total VAT = €3.81

So, the selling price of the laptop excluding VAT would be approximately €21.19.

Also visit; VAT Calculator UAE

How to Get VAT Number Malta

-

Eligibility:

Businesses that surpass a specific annual turnover threshold must register for VAT. Additionally, voluntary registration is an option.

-

Application Process:

Depending on your business type (sole proprietorship or company), you'll need documents such as:

- Identity card or passport of the applicant.

- Statutory documents like Articles of Association or certificate of registration.

- Proof of business activity in Malta.

Did you know?

Malta electricity rates are subject to a reduced VAT rate of 5%, making it one of the countries with the lowest VAT charges on electricity in Europe.

-

Choose Application Method:

If you're eligible, you can register online via the Commissioner for Revenue (CFR) eServices portal at https://cfr.gov.mt/en/vat/general_information/Pages/default.aspx

Alternatively, you can opt for the paper-based method. Simply download and fill out the VAT registration form from the CFR website and submit it by post or person at the VAT Department headquarters.

-

Processing Time:

After submitting a complete application, processing typically takes 3-4 weeks.

Malta requires electronic submission of VAT returns by the 22nd day of the second month after the end of the applicable tax period. For instance, the deadline for filing a VAT return for the quarter that ended on March 31st is May 22nd.

Conclusion

The Malta VAT Calculator is designed in a simple and user-friendly way. It can do VAT calculations for you accurately. In this way, you can ensure error-free calculations and save time.

FAQs

A business becomes eligible for VAT registration in Malta when its annual turnover is over 35,000 Euros annually. Additionally, voluntary registration is also an option regardless of turnover.

Electricity in Malta benefits from a reduced VAT rate of 5%. This is significantly lower than the standard VAT rate of 18% that applies to most goods and services.

Economic activity in Malta includes trades, businesses, professions, personal services, property exploitation for income, club services, and admissions for a fee. Public authority activities are generally exempt, except when specified in the VAT Act's First Schedule or for competition reasons.